Written by Rick Newman

What do you really need?

It’s become a national question. With jobs and money scarce, consumers are taking inventory and tossing lots of stuff once deemed important into a humongous discard pile. To safeguard the essentials—a safe home and supportive community, the kids’ education, Internet connectivity, sustenance for a pet—Americans are giving up lots of other things. Some sacrifices are painful; others bring surprise benefits.

To gauge America’s changing priorities, I synthesized market research, business trends, economic data, and reports from hundreds of consumers into a list of things that many people seem to be significantly cutting back on, or living without completely. Here are 21 of them:

Monthly payments. Old mentality: I don’t care about the price, as long as I can borrow to pay for it and I have enough income to cover the monthly payment. New mentality: I’ve already got too much debt, and the banks won’t lend me the money anyway. Result: More cash purchases and a lot less financing of cars, furniture and other costly items. “The era of unbridled, debt-financed consumer spending is over, and the monthly payer is out of action,” Eric Janszen, president of iTulip, a finance-advisory firm, wrote in Harvard Business Review last year.

Window shopping. Browsing used to be an acceptable pastime. But consumers have discovered that window shopping encourages them to buy tons of stuff they don’t need. So now, they’re shopping only when necessary, making a list and sticking to it, or skipping the mall in favor of online sites, where temptations are weaker. “I no longer spend a day at the mall when I’m bored,” says Debby Abrams of Rising Sun, Ind. “I don’t buy, rebuy, and rebuy again: Buy a lamp, buy one I like better and put the first one in the basement, then buy a third one and put the second one in the basement.”

[See 4 Things That Could derail a Recovery.]

Bells and whistles. The technology arms race is slowing, with consumers gravitating to simpler gizmos like Netbooks, prepaid cellphones, and older, used electronics. Shaving features is obviously a way to save money, but some users also find the simpler devices a relief. “My cellphone is back to being just a phone and not my connection to the rest of the world via texting or the Web,” says Dorothy Robson of Durham, N.C. “Simplicity is definitely the new thing. Now if we can get the government to be frugal, that would be great!”

Clutter. As Americans downsize, do more of their own cleaning, and look for stuff they can sell online, they’re discovering tons of things around the house they can get rid of. After Russ and Deborah Merchant of Delaware, Ohio, moved into a smaller rental home in 2007, they dug out hundreds of items they had never used and didn’t need. For a year, they gave away more stuff than they purchased. “We keep being amazed at how having less stuff, with no deprivation, actually gives us better quality of life,” says Deborah Merchant. “We’ve gained emotional and spiritual maturity.”

Cable TV. Many people are cutting back on pay-TV services or canceling them altogether, which saves $50 to $100 a month. As a replacement, some viewers watch free programs on Hulu or YouTube or make do with broadcast TV. Others are giving up television completely. “There’s no money for cable TV, so my Internet does me for all my news and other entertainment,” says Mariluna Martin of Los Angeles. “That’s money saved, plus no TV means no blaring of bad news, fear-mongering, ad pressures, and other unpleasantness.” Martin spends more time reading books and sipping tea at a neighborhood café. She finds that rewarding: “The changes I’ve had to make have made my life better. Things are simpler and healthier now.”

A home phone. How many phones do you need, anyway? With cellphones ubiquitous, the home unit is becoming redundant. Internet voice services like Skype and magicJack slash the cost of calls but still provide most of the services that are available through the phone lines. Many people are reducing their cellphone service as well. Kathy Bowman of Joseph, Ore., figures she’s saving about $800 per year since she replaced her cellphone with a prepaid Tracfone she mainly reserves for emergencies. Canceling a fax line to her home saves another $120 per year.

Privacy. Got room on the couch? To save on rent or mortgage payments, roommates are doubling up and grown kids are moving back in with their parents. Mark Hamister of Elyria, Ohio, says privacy is one of the many things he’s given up as two of his grown daughters have moved back home, bringing boyfriends, pets—and a granddaughter. But he’s not complaining. “We have learned to enjoy a simple, cost-effective, and minimalist approach to life by developing an appreciation for nature and family,” he says. “Big, expensive toys and trips were fun before, but we really don’t need them anymore.”

[See 17 Ways Consumers Are Changing.]

Prepared foods. More people are cooking at home, and they’re doing it with fewer premade sauces, marinades, dressings, and other ingredients. “Moms are back to basic cooking,” says Chance Parker, a market researcher at J.D. Power & Associates. “They want to use fresh herbs and spices. It saves money, and it’s more healthy.” Patricia Tremblay of Dayton, Ohio, has given up her microwave as she’s cut back over the last two years. She now cooks instead of zapping a premade entrée. “I’ve traded convenience for choice and done well, with the added bonus of weight loss and a sense of accomplishment,” she says. “It’s a great beginning that seems likely to stick.”

Tupperware parties. Sales of Tupperware and other storage products are up, since people are cooking at home more and husbanding leftovers. But consumers still want the best deal, and they’re skeptical of merchants—even if it’s a friend or neighbor. “I flatly refuse to go to any ‘home parties’ where the hostess is selling candles, plastic ware, etc., and she gets free merchandise,” says Lois Barber of Sandy Hook, Conn. “The stuff costs about three times what you would pay retail. My blanket excuse is, ‘My sister sells it.’ ”

Packaged cigarettes. The average price of cigarettes is about $5 a pack or $45 a carton, which mounts quickly for regular puffers. Kicking the habit is the most obvious way to save money, but short of that, more smokers are buying small machines that let them roll their own smokes. “We learned to make our own cigs with a machine that cost $40,” says one smoker. “We now save around $120 a month.”

[See 9 signs of America in decline.]

Lattes. The $5 daily coffee is always one of the first small luxuries to go. But more people are brewing at home. Sales of single-serving home brewing machines have soared.

Guilt. Keeping up with all the latest trends and technology takes an emotional toll. “When I could afford it, I always felt pressured to buy the latest software and gadgets,” says Kathryn Husby of Plantation, Fla. When job and health issues curtailed the family income, she and her husband cut back to bare necessities. That meant she didn’t have to learn a new set of buttons or menu options every year; she just kept pressing the same familiar buttons on the old model. “I’m happier than I’ve been for many years,” she says. “I feel like I’m in charge of my life instead of multinational corporations telling me what to consume.”

Extra calories. Some Americans say they’re eating less to save money and drinking more water or doing other things to suppress their appetite. Restaurants are hurting as people eat out less, but some diners are trimming the check instead of scotching the entire outing. Some strategies for lighter eating: Going out for lunch instead of dinner, sharing entrees, skipping appetizers and side dishes, and turning restaurant leftovers into one or two at-home meals. A few restaurant chains, like Panera Bread, the Olive Garden, and Buffalo Wild Wings, have even managed to gain business by offering high-quality food at slender prices.

[See 8 Restaurants on a Roll.]

Newspapers and magazines. It’s bad news for the publishing industry, but millions have canceled subscriptions to print periodicals and started getting free news and information online (which is probably where you’re reading this article!). The trend may be strongest among tomorrow’s consumers, otherwise known as teenagers: A study by the Kaiser Family Foundation found that kids between 8 and 18 spend just 38 minutes a day with some form of print media, down from 43 minutes in 2004. That’s out of a total of 7 hours and 38 minutes they spend every day using some form of media.

Healthcare. A forced reduction in healthcare coverage is probably one of the most crushing effects of a weak economy, as the unemployed and others without insurance make drastic trade-offs to cut costs and get by. Millions of Americans are forgoing doctor visits, abandoning medication, ignoring problems, and simply hoping they don’t get seriously ill or hurt. “I don’t go to the doctor as often,” says Debby Abrams. “Aches and pains work themselves out. I have some neurological thing going on in my left thumb right now, but I’m going to ignore it and attribute it to aging rather than go to a neurologist.”

New gifts. Regifting is a time-tested practice—but there’s always room to refine your strategy. Linda Amicucci of Tenafly, N.J., holds a “treasure party” with a group of friends after Thanksgiving every year to swap recyclable gifts. “We bring all the unwanted, unused items in our house that could be used as gifts or were given to us as gifts throughout the past year,” she explains. “We swap items, since a gift received last year during a grab bag cannot be regifted in the same social circle. But in a different social circle, it’s a brand new gift!”

[See 10 products that boomed during the recession.]

New cars. It’s no secret that new-car sales plunged to levels 40 percent lower than the peak in 2006. But many buyers who have traded down to a used model are surprised at the quality of the merchandise. “I have found that many people take really good care of their cars,” says Jay Bailey of Phoenix, who’s currently shopping for a used SUV. “You can find cars that have over 100,000 miles that have been maintained so well that you can easily get another 100,000 miles out of them.” Many other car shoppers apparently agree, one reason used-car prices have actually been rising, with some models hard to find.

Comfort. Thermostats all across America are going lower in winter, higher in summer. After losing his job last year, Phil Landry, a Florida software salesman, analyzed his use of utilities, among other things, and decided to shave costs by setting the temp at 86 in the summer. “Every once in awhile I’ll lower it to 84,” he says. “But as long as you’re not running marathons in the house, 86 is OK.” Carrie Chiarenza, an Army officer who is based at Fort Hood, Texas, and is currently serving a yearlong tour in Iraq, takes supershort “combat showers” when she’s at home, and she applies other tricks learned while living in the field. “Never leave any water running if you don’t have to,” she says. “So when lathering hair with shampoo, water comes off. Same thing with hand washing. Sometimes the task takes longer, but it helps the environment, and my utility bills.”

A daily commute. If you’re unemployed, obviously there’s no job to drive to, one reason the number of vehicle miles driven has dipped to 2004 levels (and traffic on some of the most congested highways has eased). Telecommuting increased during the recession as well, and more people say they’re riding bikes or walking more to save on gas costs—or a gym membership.

[See How to Live Happily on 75 Percent Less.]

Fancy dates. Online dating services like Match.com are growing, but courtship is a bit of a comedown these days. Discount-dating advisers suggest cooking at home instead of eating out, looking for free performances, browsing at bookstores, going hiking, and exploring yard sales (yes, yard sales). And some discouraged singletons are sitting on the sidelines, waiting for better times. “I am not dating,” says one woman who recently lost her job at a financial firm in San Diego. “Who will want to date an unemployed female?” Still, she says, “I am determined and motivated to survive this recession.” And date again.

Debt. Who needs it? “I have learned that it takes little time to run dangerously high credit card balances,” says Tom Poirer of Lowell, Mass., “but an inordinately long time to pay it back. I have learned to deprogram myself from the consumerist mayhem.” Many Americans seem to agree. Total credit card debt is about 7 percent lower than it was a year ago, and Americans have paid down more than $100 billion in credit card loans and other types of revolving credit since October 2008. We may ultimately end up with less stuff. But at least we’ll be able to afford what we have.

If you’re going to have to entirely ignore your kids and family when you’re working at home, you might as well head into the office. Career columnist and Wall Street Journal writer Alexandra Levit offered up six tips for working parents to spend more time parenting. They were aimed at anyone with a job, but freelancers certainly have an easier time of shifting their schedules back and ahead, taking web meetings instead of traveling for in-person summits, and involving their children in their work. Photo by Amit Chattopadhyay.

If you’re going to have to entirely ignore your kids and family when you’re working at home, you might as well head into the office. Career columnist and Wall Street Journal writer Alexandra Levit offered up six tips for working parents to spend more time parenting. They were aimed at anyone with a job, but freelancers certainly have an easier time of shifting their schedules back and ahead, taking web meetings instead of traveling for in-person summits, and involving their children in their work. Photo by Amit Chattopadhyay. Why freelance on the side instead of full time? The taxes are a lot more simple, the income a bit more stable, and, best of all, your day-to-day job provides you with countless opportunities to meet and greet future clients and referral helpers. That’s assuming your side gig is kosher with your boss, of course, but if you want to test the waters of selling yourself on the freelance market, do it without quitting your job.

Why freelance on the side instead of full time? The taxes are a lot more simple, the income a bit more stable, and, best of all, your day-to-day job provides you with countless opportunities to meet and greet future clients and referral helpers. That’s assuming your side gig is kosher with your boss, of course, but if you want to test the waters of selling yourself on the freelance market, do it without quitting your job. Becoming your own Accounts Payable department is new to most freelancers, and not very fun. If you run into clients who are hesitant to pay on time, or leave you on the hook waiting for their next order, try offering a discount or repeat business incentives, as suggested by Web Worker Daily. Give clients a 5 percent discount if they pay within, say, 24 or 48 hours of invoice shipment, or whatever you consider prompt—the cash value is almost certainly worth the time you’ll spend tracking it down and worrying. If clients make you wait forever for their next order, offer a coupon or discount after receiving payment on a gig, giving them a small bit off if they place another order within a certain time frame. It’s easy for small businesses to lose track of freelance people, but they tend to pay attention to dollars and cents. (Original post)

Becoming your own Accounts Payable department is new to most freelancers, and not very fun. If you run into clients who are hesitant to pay on time, or leave you on the hook waiting for their next order, try offering a discount or repeat business incentives, as suggested by Web Worker Daily. Give clients a 5 percent discount if they pay within, say, 24 or 48 hours of invoice shipment, or whatever you consider prompt—the cash value is almost certainly worth the time you’ll spend tracking it down and worrying. If clients make you wait forever for their next order, offer a coupon or discount after receiving payment on a gig, giving them a small bit off if they place another order within a certain time frame. It’s easy for small businesses to lose track of freelance people, but they tend to pay attention to dollars and cents. (Original post) The web is full of freelancers and contractors, and many of them have created better systems for tracking time and sending bills. There are too many free or “freemium” services to try and compile into one list, but, hey, let’s throw out a few. MakeSomeTime is simple, CurdBee handles everything up to the Google Checkout/PayPal payment screen for clients, FreshBooks covers a lot of different aspects of billing, Toggl is a great second-by-second live tracker, and BlinkSale has been generating crisp-looking invoices for years. Any of them are worth checking out, and probably fit the bill better than a gigundo spreadsheet. (Original post)

The web is full of freelancers and contractors, and many of them have created better systems for tracking time and sending bills. There are too many free or “freemium” services to try and compile into one list, but, hey, let’s throw out a few. MakeSomeTime is simple, CurdBee handles everything up to the Google Checkout/PayPal payment screen for clients, FreshBooks covers a lot of different aspects of billing, Toggl is a great second-by-second live tracker, and BlinkSale has been generating crisp-looking invoices for years. Any of them are worth checking out, and probably fit the bill better than a gigundo spreadsheet. (Original post) If you’re starting to get actual, notable income from your freelance work, the first thing you should do is find someone who know how to handle the taxes of independent contractors. Gina proved the value of a good accountant in her human versus TurboTax.com showdown, but noted that an experienced filer could probably make due with the tax software solution. The Freelance Switch blog also offers 10 easy-to-miss freelancer deductions, like coffeeshop meetings, unpaid invoices, and gig hunting expenses, that any independent worker would do well to look into. (Original post)

If you’re starting to get actual, notable income from your freelance work, the first thing you should do is find someone who know how to handle the taxes of independent contractors. Gina proved the value of a good accountant in her human versus TurboTax.com showdown, but noted that an experienced filer could probably make due with the tax software solution. The Freelance Switch blog also offers 10 easy-to-miss freelancer deductions, like coffeeshop meetings, unpaid invoices, and gig hunting expenses, that any independent worker would do well to look into. (Original post) Cold calling is not fun, and if you think it might be, watch Glengarry Glen Ross again. A good lead comes from knowing where people are looking. FreelanceSwitch has compiled a monster list of freelance job sites, though some of them are going to be hired-gun-type, low-paying grunt work. On the other hand, a 10-minute call to your clients can get you all kinds of results you weren’t even looking for. (Original post)

Cold calling is not fun, and if you think it might be, watch Glengarry Glen Ross again. A good lead comes from knowing where people are looking. FreelanceSwitch has compiled a monster list of freelance job sites, though some of them are going to be hired-gun-type, low-paying grunt work. On the other hand, a 10-minute call to your clients can get you all kinds of results you weren’t even looking for. (Original post) Who should you call with a reminder that you’re available, and who needs a quick follow-up on a pitch? Those are questions you should have answers for. Web Worker Daily’s Celine Rogue explains how to set up a spreadsheet with drop-down choosers, collated data, and other tools to become a great pitch, client, and job tracker. Half of life is just showing up, after all, and some extra percentage is knowing exactly where and when to be present with an offer. (Original post)

Who should you call with a reminder that you’re available, and who needs a quick follow-up on a pitch? Those are questions you should have answers for. Web Worker Daily’s Celine Rogue explains how to set up a spreadsheet with drop-down choosers, collated data, and other tools to become a great pitch, client, and job tracker. Half of life is just showing up, after all, and some extra percentage is knowing exactly where and when to be present with an offer. (Original post) If you don’t cover the tax burden throughout the year of not having an employer to deduct social security, unemployment, and other taxes for you, the month of April will truly be the cruelest. Read how our own self-employed readers set aside money for estimated taxpayments four times each year (or in other installments), and read how Gina automates her finances to always have the money on hand, even when her income is very variable.

If you don’t cover the tax burden throughout the year of not having an employer to deduct social security, unemployment, and other taxes for you, the month of April will truly be the cruelest. Read how our own self-employed readers set aside money for estimated taxpayments four times each year (or in other installments), and read how Gina automates her finances to always have the money on hand, even when her income is very variable. Besides having to learn the basics of contracts and work rules, freelancers should try to grab the basics of selling and regulating resalable (and different) stock work, as well as know how to stand their ground on copyright, fair use, and Creative Commons. It is, in short, not enough to simply create cool things—you have to know how to shepherd them through the cloudy worlds of commerce and the web these days. Photo by MikeBlogs. (Original posts: legal resources, stock work).

Besides having to learn the basics of contracts and work rules, freelancers should try to grab the basics of selling and regulating resalable (and different) stock work, as well as know how to stand their ground on copyright, fair use, and Creative Commons. It is, in short, not enough to simply create cool things—you have to know how to shepherd them through the cloudy worlds of commerce and the web these days. Photo by MikeBlogs. (Original posts: legal resources, stock work). Not every contract will rely on hourly rates, but you’d best be prepared to offer a price if someone asks. The general advice is to aim slightly higher than you figure you should really charge, because you will always, always aim low when you’re determining the time and administrative costs of getting the job done. If you want a more concrete number to base your rate on, try FreelanceSwitch’s hourly rate calculator, which takes your office and supply costs, experience, and other factors into account. (Original post)

Not every contract will rely on hourly rates, but you’d best be prepared to offer a price if someone asks. The general advice is to aim slightly higher than you figure you should really charge, because you will always, always aim low when you’re determining the time and administrative costs of getting the job done. If you want a more concrete number to base your rate on, try FreelanceSwitch’s hourly rate calculator, which takes your office and supply costs, experience, and other factors into account. (Original post)

Well before yesterday’s grand unveiling of Apple’s long-awaited tablet computer, rabid fans began filming their own mock ‘commercials.’

Well before yesterday’s grand unveiling of Apple’s long-awaited tablet computer, rabid fans began filming their own mock ‘commercials.’

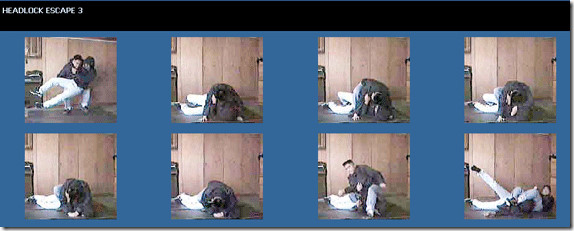

The first rule about fight club is that we don’t talk about….oh wait that is the other club. So you want to learn to fight like a Ultimate Fighting Champion? You want to rule the streets and kick sand in a bigger guy’s face?

The first rule about fight club is that we don’t talk about….oh wait that is the other club. So you want to learn to fight like a Ultimate Fighting Champion? You want to rule the streets and kick sand in a bigger guy’s face?

Grill

Grill Massive HDTV

Massive HDTV Playstation 3/Xbox 360 with internet connection

Playstation 3/Xbox 360 with internet connection Internet porn

Internet porn Massage Chair

Massage Chair A sex robo

A sex robo The combination of all of the above into one awesome “Mancave”

The combination of all of the above into one awesome “Mancave”