Written by Stan Reybern

Critics of the public school system have long lamented the lack of personal finance education in our classrooms. As many have pointed out, today’s high schools rarely teach even the basics. Consequently, students often graduate high school unable to so much as balance a checkbook or compare two different loans. Yet as embarrassing as this is, our schools also neglect a whole slew of more advanced financial concepts. While some are covered in various college courses, the only group of students likely to have encountered all of them are MBAs. In reality, they apply to everyone, not just business owners. If you are not an MBA or are simply curious to learn about some of the important financial concepts overlooked in school, consider the following.

Probability

Probability seeks to measure how likely it is that various things will happen and express those odds as a percentage. A coin toss, for instance, has a probability of 50% because it is equally likely that it will flip heads or tails. Banks use probability (albeit in more complicated ways) to determine the odds that borrowers of various creditworthiness will repay their loans and, thus, what interest rate to charge. While many believe that banks charge high or low interest out of “greed” or “favoritism”, it is ultimately a total numbers game. If probability shows that borrowers with your characteristics pay on time, you pay less. If it shows the opposite, you pay more. Understanding probability can put such decisions into perspective and empower you to make better ones yourself.

Statistics

While probability is about predictions, statistics is about measurement. Generally speaking, there are two kinds of statistics: descriptive and inferential. Descriptive statistics simply reflect the inarguable facts of the data. The heights, weights, genders and eye color of a thousand randomly assembled people would be examples of descriptive statistics. Inferential statistics go a step further by attempting to draw conclusions from the descriptive ones. An example of an inferential statistic might be a theory about how “80% of all people living in this area have brown eyes.” Statistics, like probability, is used across the economy and shapes billions of financial decisions large and small every single day.

Sunk Costs

A sunk cost is an amount of money that has already been spent and cannot be recovered. Cars purchased, years spent in careers and portions of meals already consumed are all sunk costs. Unfortunately, because human beings are naturally risk-averse, we are often slow to acknowledge sunk costs and change course. We frequently hear friends or relatives justify staying at jobs they despise because of all the time they’ve worked there. Others will actually force themselves to choke down disgusting restaurant food to “get their money’s worth.” But all they are doing is throwing good money after bad by prolonging the original mistake. Instead, true financial rationality demands that you emotionlessly cut your losses as soon as a sunk cost is recognized. Time and money already spent (and which you cannot get back) should not affect what you decide to do next.

Expected Value

Expected Value is a specific and immensely useful application of probability. In simplest terms, it is an expression of the long-term average odds that something will happen. You get it by taking an outcome and multiplying it by the probability that it will happen. The number you wind up with is the Expected Value of that action. While this might sound like abstruse financial jargon, it is anything but. Everyone who buys lottery tickets, for instance, is either unaware of or ignoring the concept of Expected Value. Based on the calculations just described, forking over $10 for buys you a piece of paper with an Expected Value of $5. Seen from this perspective, buying lottery tickets actually reduces your net worth. An index fund, on the other hand, is an example of something with a positive Expected Value that could rationally be expected to grow your net worth.

Mental Accounting

Another financial mistake we often make is classifying money into arbitrary but seemingly meaningful categories. We hear investors tell us, for example, what they do with “money they can afford to lose.” As kids, many of us probably spoke eagerly about our plans for birthday money that we “weren’t expecting anyway.” A Washington Post article described a study where 86% of people bought a $10 movie ticket after losing $10 on a train, but only 46% bought a second $10 ticket after losing the original. This is a fallacy known as mental accounting. In all the above examples, people are making apples-to-oranges comparisons out of identical things. There is no dividing line between money that matters and money you can afford to lose, or between money you worked hard for and money you weren’t expecting. It is all the same resource: money. Economically speaking, you should make these decisions based solely on Expected Value rather than imaginary categories.

Time Value of Money

The time value of money states that money today is worth more than money tomorrow. Money already in your possession can be put into investments or savings and earn interest. Investopedia offers an apt example:

Assuming a 5% interest rate, $100 invested today will be worth $105 in one year ($100 multiplied by 1.05). Conversely, $100 received one year from now is only worth $95.24 today ($100 divided by 1.05), assuming a 5% interest rate.

Keep this in mind when someone makes an offer for your house or other property. A seller who offers you “more money later than he can give you today” and tries to make it sound attractive could, in truth, be offering less than today’s “smaller” amount. The old saying “get the fast buck, not the last buck” nicely captures the time value of money.

Risk Management

Astonishing numbers of people have little or no appreciation of true risk management. Mention the risks of any activity and you are likely to hear dismissive responses like “there’s risk in everything” or “you could get killed crossing the street.” Frankly, this is a lazy and ignorant view of what risk truly is. It is not enough to simply assume that risk is present equally in everything so why bother thinking about it. Each activity entails different types of risks and different probabilities that they will materialize. You need to quantify any serious risks that are encountered. The decision of where to buy a home, for instance, should be made partially based on historical property values and the likelihood and they will rise or fall. For extremely important choices, it might help to construct a formal decision tree that visually displays possible outcomes and their Expected Values.

Leverage

Borrowing money (also known as leverage) is another common source of confusion among the public. Besides attributing high or low interest rates to greed and favoritism, many people fail to comprehend the basic, underlying mechanics of borrowing. The idea of interest can prove especially confusing. Yet, it is crucial to understand what is actually happening when you borrow money. Take the easy example of a car loan. While your new car might cost, say, $28,000, borrowing the full purchase price costs far more than that. Using a cost of loan calculator, we find that borrowing $28,000 at 6% interest and repaying it over 5 years costs $32,479 when all is said and done.

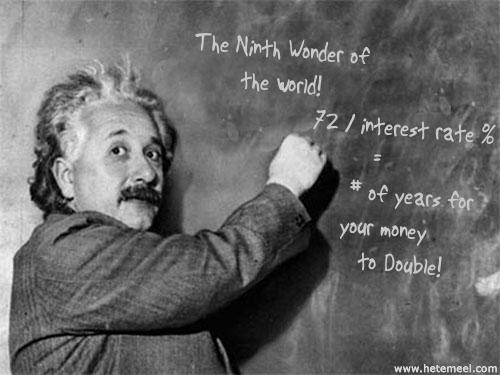

Compound Interest

If you’ve ever wondered why financial experts are always telling people to take advantage of tax-deferred 401(k) and IRA accounts, the mystery is solved. Compound interest is the reason. If you put $10,000 into an index fund earning 6% interest and do nothing, it will be worth $57,434.91 in thirty years. That’s because the interest on your original $10,000 is itself earning interest with each passing year. Of course, the returns are even sweeter if you continue putting money in, but the power of compound interest should now be clear. Furthermore, with a Roth IRA, all of this accumulated growth is untouched by income taxes.

Inflation

You might have heard various analysts and experts claim that some low rate of return (say, 1% or 2%) “doesn’t even beat inflation.” Inflation refers to a gradual, yearly rise in the prices of everything in the economy. Because the government prints more money each year, it loses its buying power at a rate of between 2%-4% annually. In other words, $500 today can buy more goods and services than it will buy a year or two from now. According to the Heritage Foundation, Social Security provides low or even negative returns to various segments of society because of inflation. When making financial decisions (such as evaluating investment performance or yearly income) you must always determine the inflation-adjusted, or “real” rate of return. Neglecting inflation creates a rosier picture, but is nothing more than an exercise in self-delusion.

Opportunity Cost

Opportunity cost refers to the value of your foregone options. The opportunity cost of attending college, for instance, might be the income you could earn at a job if you weren’t in school. The opportunity cost of going to a party might be a lower grade on the test because you didn’t study. Every choice in life, big and small, entails opportunity costs. Nor are they always this obvious. Many “do it yourself” projects are actually a waste of time and/or money when opportunity cost is considered. Let’s say it takes you six hours to do your own taxes, during which you cannot work on your business. If six hours working on the business would have produced more than the cost of an accountant, doing it yourself was a waste. To view it any other way is sheer mental accounting. While you did not physically hand money over, the greater sum of business income you sacrificed means you should have.

Risk vs. Reward

One of the most basic ideas underlying many of these concepts is that risk and reward are positively correlated. There is relatively little payoff involved when an activity is extremely safe. As the old saying goes, “if it were easy, everyone would do it.” This is why savings accounts (backed by federal deposit insurance) pay only 1%-2% interest while stocks (which can crash in a heartbeat) routinely pay 5%-10% or more. It is also why working a low-intensity desk job for fifty years is a lot less lucrative than owning an actively managed business. One is relatively sure thing, while the other contains much uncertainty and risk.

Where do I get that cool version of the boardgame Risk! ?

This is a good summary. In working with different small business owners each month, I find oppurtunity cost and mental accounting to be the most stubborn issues to work through.